We could all do with a little extra money, but many of us are terrible at actually saving money. Why? Because personal finance was never taught to many of us. Our teachers never talked about it and our parents failed to teach us about savings either.

Those who think they are good at saving money are probably using the most common pieces of savings advice out there such as “save 10% of each paycheck” or “build a rainy day fund”.

While both are good pieces of advice they only get us so far in today’s modern world stagnant income and increased living expenses.

Here are five savings tips you will not have heard before that have been developed for the modern world:

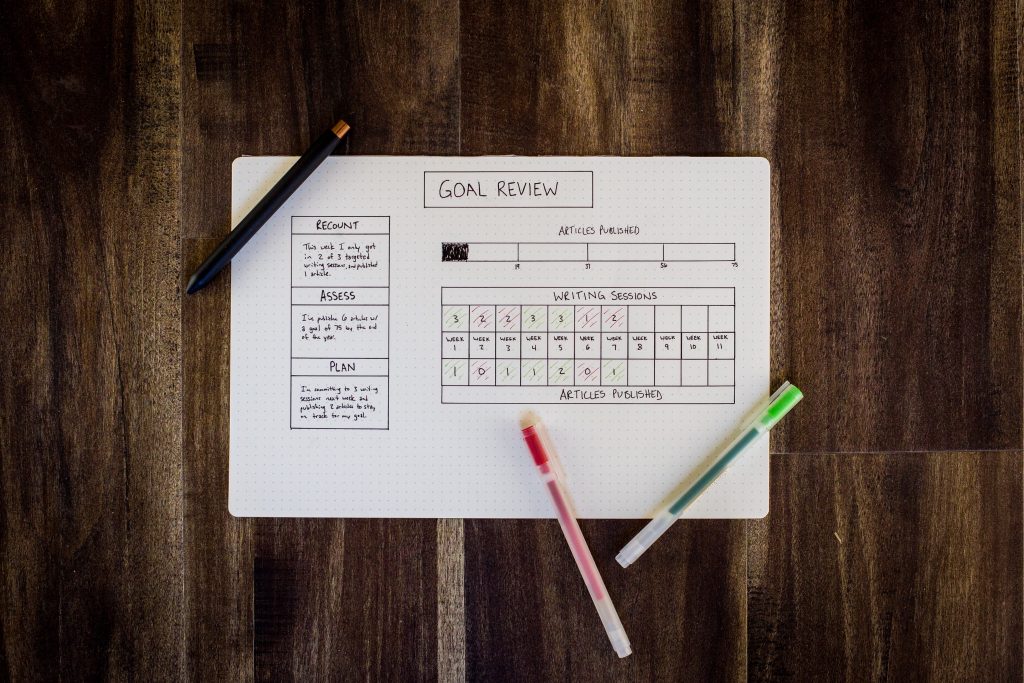

1. Go After Short-Term Savings Goals

That does not mean you should abandon your long-term goals. Instead, break your long-term savings goals into shorter and more manageable chunks that keep your savings exciting and consistent.

When looking to buy things that you cannot afford, develop a short-term savings strategy to get you there. It should never be a case of “I just cannot afford that”, it should be “I can afford that in X months if I start saving $X per month”.

Short term goals amount to long-term wealth creation.

2. Make Your Savings Goals Personal

Nobody wants to save for things they do not want or they do not see value in. Always make sure you are saving for things that mean something to you. This way, your savings goals are more interesting and you are more likely to stay consistent and on target.

Savings for things you do not need and are not truly connected too is a long and arduous process that may never come to fruition.

3. Cutting Costs Can Be More Effective Than Spending

Sometimes to create more wealth you need to trim the fat in your expenditure. Do not just look at savings goals, consider what costs you can reduce.

You should try looking into prepaid electricity, cancelling expensive subscriptions, installing energy-efficient appliances, and taking advantage of renewable energy applications. Reducing costs and saving money on existing bills can go a long way for your overall savings goals.

4. Pay Yourself Last

A common piece of advice in the personal finance world is to always pay yourself first. This is a great way to start saving, but it does not work for everyone. In fact, paying yourself last creates a system where you must spend more frugally during the month in order to save your target amount.

Often, when people pay themselves first they end up running short on money towards the end of the month and taking chunks out of what they already put away into their savings. Pay yourself last.

5. Focus on $100,000

We all want to retire as millionaires and many of us spend our lives trying to reach that high number and fail. Instead, focus on $100,000. It will not be easy, but you are more likely to save $100,000 than $1m.

Once you have a $100,000 the next $100,000 comes much easier and it will continue to get easier as you move from $100,000 to the next. Small baby steps will lead you to the primary goal. Focusing on an unrealistic large number will hold you back.