Bookkeeping precedes accounting and is a part of the accounting system used to generate various types of business transactions reports. Accounting helps to interpret and analyze the records of financial transactions captured by the bookkeeping system. As explained by Brian C Jensen, financial transactions include earned revenue, sales, earned interest, payment of taxes, payroll, loans, investments, and other operational expenses. Financial statements used by companies are forms used to display bookkeeping entries.

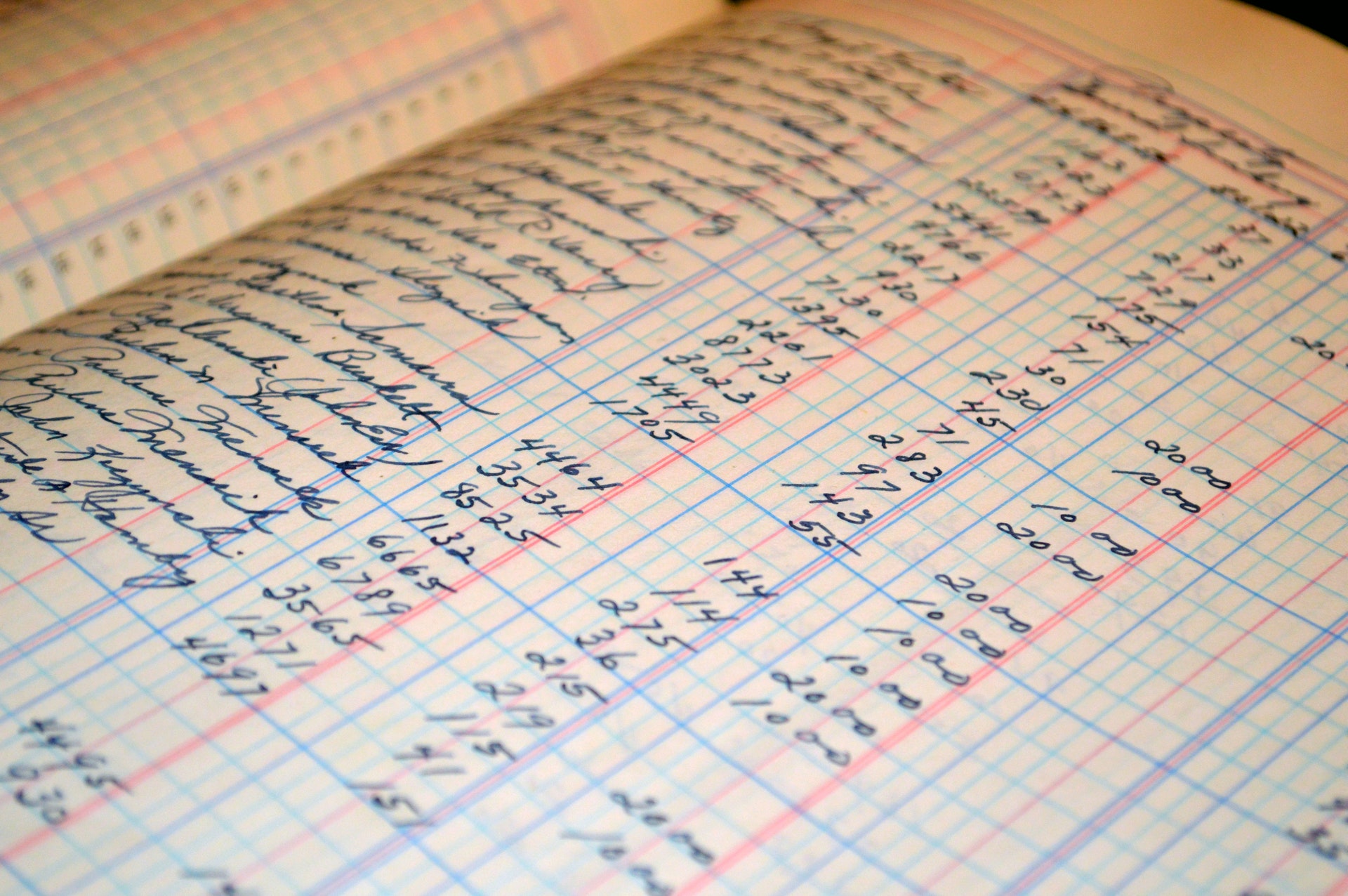

The statements throw light on some specific aspects of the financial activities of a company, like assets, cash flow, connected expenses, and revenue. Some small businesses rely on manual bookkeeping by using paper journals and ledgers, with others use some accounting software. Some others use a combination of both. The software allows automatic calculations and categorizations of transactions by using some accounting codes.

Brian C Jensen defines what an accounting period is

The accounting period is the time chosen by a business for opening and closing the financial books, and it becomes a part of the bookkeeping system. The accounting period impacts all software and usually includes customizable ledgers of the company’s finances, including financial history and taxes. Two kinds of accounting periods are in use and the company can choose either the calendar year or the fiscal year, whichever suits the business.

The accounting period of the fiscal year can end on the last day of any month of the year except December. For example, the fiscal year of the US government is from 1st September through 31st August. Companies that sell seasonal products might choose a fiscal year that can favorably reflect revenues and expenses. However, corporations and partnership companies must follow the fiscal year as stipulated by the IRS.

Bookkeeping methods

Businesses choose between the single and double entry systems bookkeeping methods, while some companies use a hybrid model. According to Brian C Jensen, single entry means entering one entry for each financial transaction or activity is the norm for the single entry system, while entering double entries for each transaction or activity is the norm for the dual entry system. The single entry system is the most basic, and being cash-based is ideal for recording cash flow and generating relevant reports. The double entry system is more robust with checks and balances as each debit entry requires a corresponding entry. All debt and revenue transactions find a place in the double-entry register.

Accounting methods

Financial transactions captured through receipts and other documents are posted in ledgers that summarize the recorded transactions. Customizable ledgers are included in Accounting software. The pattern of posting financial transactions can be daily or posted in batches, or some companies use an outsourced accounting service to do the posting. Regular posting helps to obtain real-time data for generating current reports and financial statements. Documentation of financial transactions and their archiving is critically important as it is the pillar of its bookkeeping system. Retaining all documents physically in files and folders is essential to substantiate the recorded data.

The document retention time f retention for the documents depends on the tax requirements as well as the policy of the company.